The global heavy metalworking industry enters 2025 in a state of profound transformation. It is simultaneously influenced by technological innovation, decarbonization of production, new environmental standards, process automation, and a shortage of skilled labor. Manufacturers working with large structures, industrial machinery, and steel products must adapt today — otherwise, they risk losing competitiveness.

Below are the main trends defining the future of the global heavy metalworking industry in 2025.

1. Demand and Market Conditions

According to the World Steel Association, after a downturn in 2022–2023, global steel demand is gradually recovering in 2024–2025. The strongest growth is expected in India, Southeast Asia, and markets connected with infrastructure, transportation, and energy.

Europe, however, shows slower recovery due to high energy prices and stricter environmental regulations.

Analysts note that in 2025, the global steel market will remain volatile. Companies should flexibly plan raw material supplies, diversify sales markets, and account for possible price fluctuations in rolled metal and energy.

2. Decarbonization and the Shift to “Green” Steel

One of the decade’s main challenges is reducing the carbon footprint of steel production.

The world is moving away from traditional BF–BOF processes toward more sustainable DRI–EAF technologies — direct reduction of iron using hydrogen or natural gas and melting in electric arc furnaces.

Projects such as H₂ Green Steel (Sweden) and HYBRIT (a joint initiative of SSAB, LKAB, and Vattenfall) prove that hydrogen-based steel production is both feasible and commercially promising.

According to the International Energy Agency (IEA), achieving Net Zero by 2050 requires large-scale adoption of DRI–H₂ technologies, increased scrap recycling, improved energy efficiency, and Carbon Capture (CCUS) implementation.

Green steel is already becoming a commodity with a premium price in the EU market.

3. Regulatory Changes: CBAM and Carbon Standards

By the end of 2025, the Carbon Border Adjustment Mechanism (CBAM) will be fully operational in the EU.

This carbon border adjustment mechanism will impose additional fees on imported steel produced with high CO₂ emissions, encouraging manufacturers to switch to eco-friendly technologies.

According to the World Economic Forum – Net-Zero Industry Tracker, CBAM will be a key driver accelerating the modernization of European metallurgy.

Meanwhile, Asian countries continue expanding traditional production capacities, creating a risk of “carbon assets” that could soon lose value under stricter global standards.

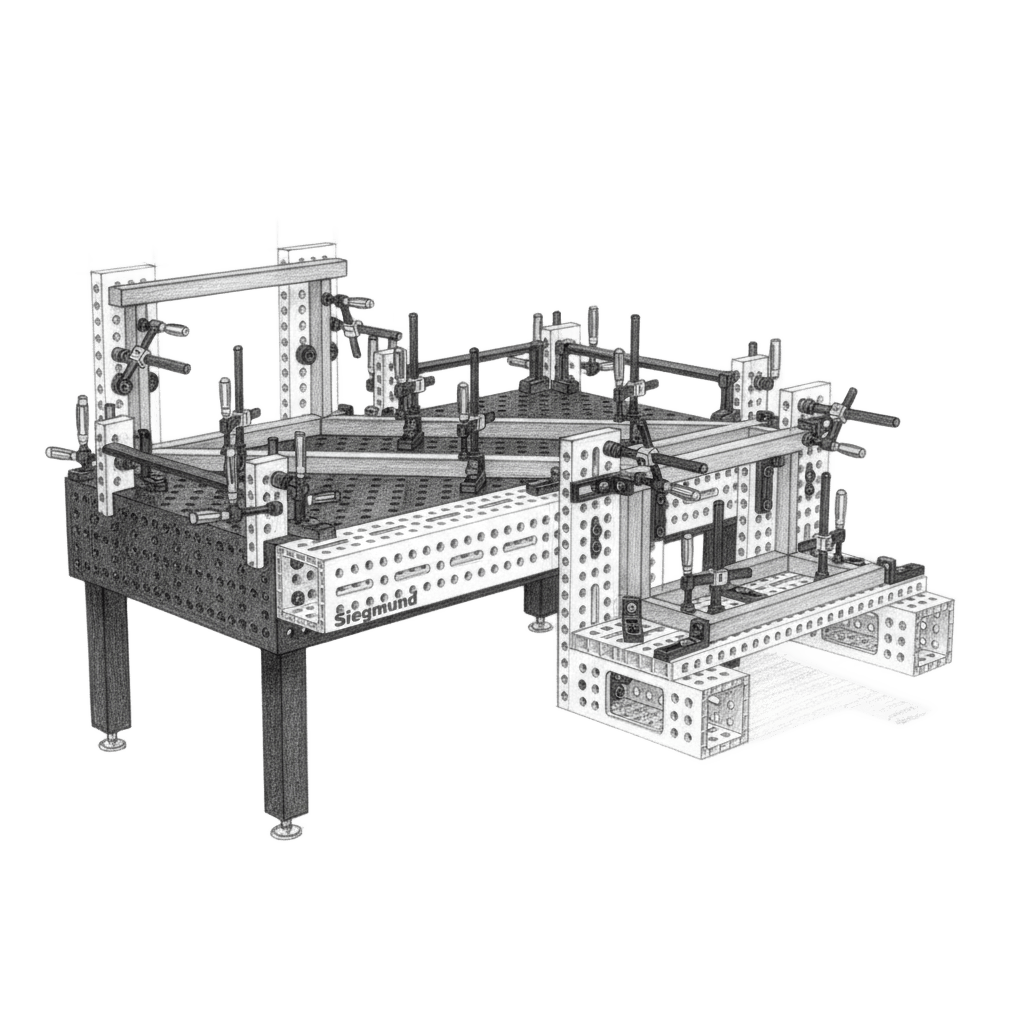

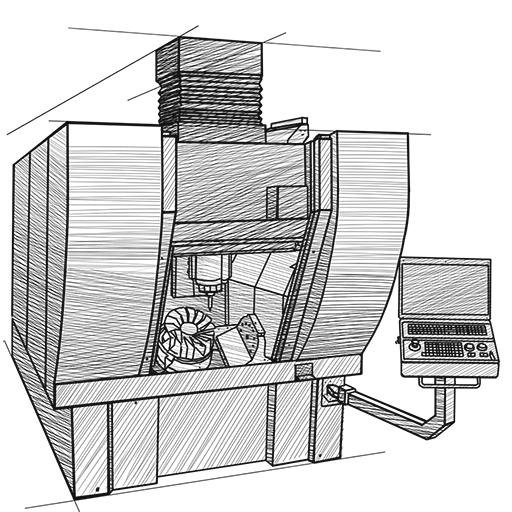

4. Digitalization and Automation of Production

Industry 4.0 is becoming the new standard in metallurgy, with increasing adoption of:

• robotic welding,

• automated cutting and milling,

• monitoring systems (IoT),

• digital twins,

• MES and SCADA systems.

According to The Fabricator, by 2025, over 60% of metalworking enterprises in the US and Europe will have implemented integrated digital control systems, reducing downtime, improving precision, and optimizing human resource use.

5. Recycling and Circular Economy

Worldsteel emphasizes the importance of scrap metal recycling.

In 2025, digital steel passports and material tracking systems are actively introduced, ensuring supply chain transparency.

The goal is to reduce emissions, decrease consumption of primary ore, and achieve sustainable production.

6. Logistics Transformation and “Friendshoring”

Following the pandemic and geopolitical crises, manufacturers are turning to friendshoring — locating production closer to target markets.

This means:

• less dependence on global supply chains,

• faster component delivery,

• lower logistical risks.

For European and Ukrainian companies, this represents an opportunity to strengthen their positions in energy machinery manufacturing and heavy equipment sectors.

Sources:

• World Steel Association, Short Range Outlook 2024–2025, World Steel in Figures 2024

• OECD, Steel Market Developments Q4-2024

• IEA, Iron & Steel Technology Roadmap, Net-Zero by 2050 Tracker

• World Economic Forum, Net-Zero Industry Tracker 2024

• The Fabricator, 2025 Industry Outlook

• Financial Times, Hydrogen and Green Steel: Europe’s Next Industrial Revolution

• Reuters, H2 Steel Projects Transform Global Metallurgy

+38 (098) 127 45 85

+38 (098) 127 45 85

+38 (050) 673 51 21

+38 (050) 673 51 21