Market Overview

After a weak 2024, the European machine tool sector is entering a phase of cautious recovery. According to CECIMO, machine tool consumption in EU+EFTA countries is expected to grow by around 4.1% in 2025 (about 7% globally). These forecasts are confirmed by official CECIMO releases at the end of 2024.

In Germany, the leading indicator for Europe, VDW/VDMA reported a double-digit drop in orders in 2024, but in the first half of 2025, early signs of stabilization are visible — orders remain low, yet the market is slowly leveling off.

Meanwhile, the global wave of automation continues: according to IFR, there are now over 4.28 million industrial robots operating worldwide (+10% year over year), with annual installations exceeding 500,000 units for the third consecutive year; 70% of new robots are installed in Asia. This directly impacts the configuration and connectivity of CNC workshops.

The Core of the 2025 Workshop: What Industry Leaders Choose

1. Five-Axis Machining, Combined Operations, and Pallet-Flow Systems

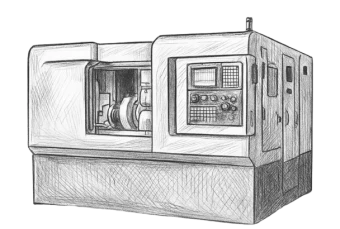

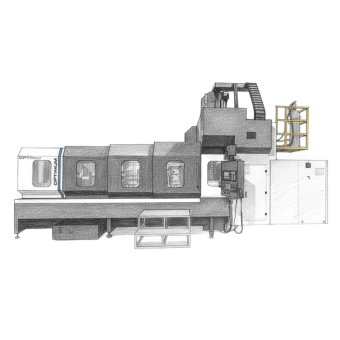

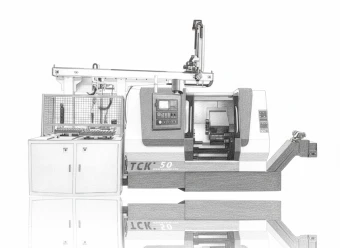

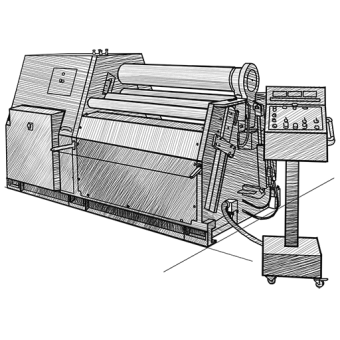

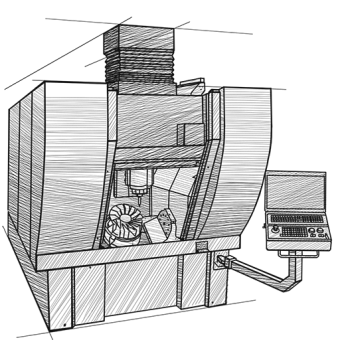

The main driver of modernization is the rise of 5-axis machining centers and mill-turn machines that combine multiple operations in a single setup.

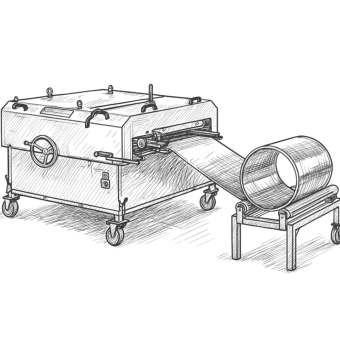

A critical accessory — pallet pools and robotic cells — enables lights-out production and continuous part flow.

Case studies from Modern Machine Shop show how a 5-axis machine with a 10-pallet pool eliminated setup bottlenecks and increased OEE (Overall Equipment Effectiveness).

➡ For mixed and complex parts, the combination 5-axis + pallets + robot/AGV is often more efficient than adding more 3-axis machines.

2. Robotic Loading and Unloading as the Default

Collaborative robotic cells for part loading, fixture change, and initial inspection are becoming standard.

What was considered a “major project” just a few years ago is now routine integration, supported by IFR data and system integrator reports.

3. “Precision Periphery”: In-Process Measurement

Leading Top Shops (MMS) systematically implement in-process probing, automated pre-set stations, and DNC-based geometry control.

This removes human error, ensures consistent 5-axis surface accuracy, and maintains tool wear control in real time.

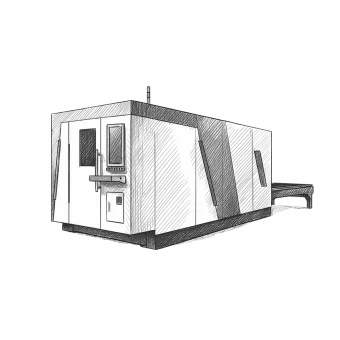

4. Data, Connectivity, and Operational Analytics

A modern CNC shop is now a node in a digital network: machines are connected to MES/ERP systems, tracking downtime causes, program queues, and tool signals via MTConnect, OPC UA, and umati.

Metrics have become a foundation for data-driven strategy, from maintenance scheduling to production routing.

➡ It’s data that distinguishes top-quartile performers (MMS benchmarks) from the average market.

Strategy for Workshop Owners and Process Engineers

Investment checklist for the next 12–18 months:

— Start with your bottleneck: if setups are the issue — add a pallet pool or robotic cell; if accuracy — focus on 5-axis + probing + stable CAM chain.

— Digitize real-time operations: connect machines to MES/SCADA with basic tags (status, program, downtime reason, tool signal).

— Standardize tooling: zero-point systems, unified fixtures, and shared tool libraries.

— Invest in training: robot technician, 5-axis operator, and CAM programmer — the three key roles in leading workshops.

Technical Priorities for Long-Term ROI

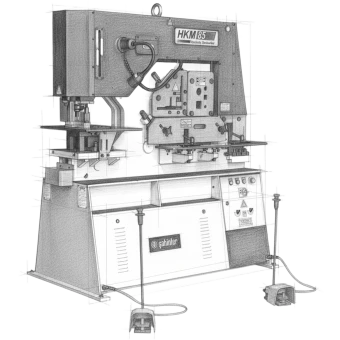

— 5-axis machining (“3+2” and full simultaneous) — achieving the right balance between precision and cycle time.

— Mill-turn integration — minimizes setup errors and logistical losses.

— Pallet pools and unmanned night shifts — once processes are stable, transition to lights-out to cut costs.

— Tool control — pre-setting, wear tracking, vibration/moment monitoring, automatic replacement.

Risks

— CapEx without process = “iron on a pallet”: even the best 5-axis machine won’t deliver ROI without rethinking workflows, tooling, and data integration.

— Overreliance on AI-generated toolpaths — precision depends on clean CAM geometry, verified post-processors, and proper fixturing.

— Workforce gaps — micro-training focused on specific cells (robot, pallet, 5-axis) delivers faster autonomy than general courses.

Conclusion

The global CNC equipment market enters 2025 with moderate recovery in Europe and accelerated automation worldwide.

Three technical pillars that consistently raise productivity and margins:

1. 5-axis + mill-turn

2. Pallet pools and robotics

3. Data and process control (MES, OEE, in-process monitoring)

➡ Manufacturers that integrate these three elements achieve predictable takt time, lower cost per part, and greater resilience in an uncertain market.

Sources

CECIMO — Machine tool consumption forecast for 2025.

VDW/VDMA — 2024–H1 2025 reports: order decline, stabilization indicators.

IFR (International Federation of Robotics) — World Robotics 2024: 4.28 million robots (+10%), 541K installations.

Modern Machine Shop (Gardner) — Top Shops 2024/2025: automation, 5-axis, and pallet-pool case studies.

+38 (098) 127 45 85

+38 (098) 127 45 85

+38 (050) 673 51 21

+38 (050) 673 51 21